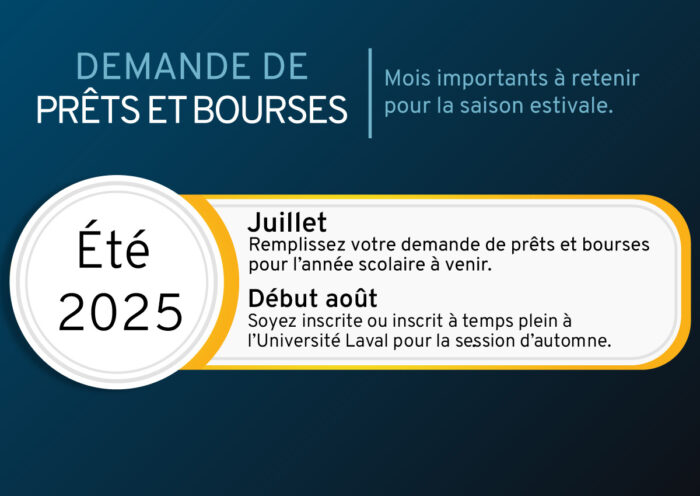

Demande de prêts et bourses

C’est le moment de faire votre demande de prêts et bourses!

Voici les moments clés à retenir.

Juillet: Remplissez votre demande de prêts et bourses pour l’année scolaire à venir.

Août: Dès le début du mois, assurez-vous d’avoir le statut étudiant à temps plein à l’Université Laval pour la session d’automne.

Vous avez des questions?

Contactez-nous par téléphone ou par courriel.

Nous joindre