Managing your budget

Sound financial health starts with making, understanding, and respecting your own personal budget. With practice and good advice, you will develop your budgeting skills in no time! Check out the resources available below to help you make a budget.

Fees

Proper planning is essential to ensure you have the financial resources necessary to meet your needs and pay for your studies. Be sure to review the detailed information available about your tuition and other fees.

Fees

Sample expenses

Here are examples of essential expenses to plan for your study project, according to your student profile, in order to know the income that will be necessary to balance your budget throughout your academic career. These examples are intended to inform you about the cost of living in Quebec City and savings to plan. Find out about financing options to suit your profile.

| International students* | Canadian citizens and permanent residents |

|---|---|

| Sample expenses – Undergraduate studies | Sample expenses – Undergraduate studies |

| Sample expenses – Master’s studies | Sample expenses – Master’s studies |

| Sample expenses – Doctoral studies | Sample expenses – Doctoral studies |

*Visit the Managing your money page on the Bureau de la vie étudiante de l’Université Laval Website to get information about: Bank account, Transferring money, Main financial institutions, Debit and credit cards.

Budget tools

Creating a budget is not as tedious as you might think, and the benefits are undeniable. A budget can help you figure out your priorities, achieve specific financial goals, reduce stress, prepare for the unexpected, and avoid the consequences of excessive debt.

The Bureau des bourses et de l’aide financière provides you with the following tools that allow you to establish a personalized budget to better guide you in your financial decisions and thus help you improve and maintain good financial health:

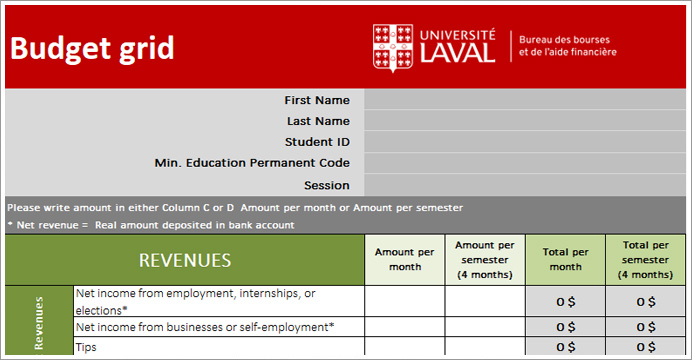

Budget management grid: Simple and especially designed for university students

Faistonbudget.ca: Online interactive tool

The Faistonbudget.ca website features an interactive calculator to help you create a personalized budget. It will also help you update your knowledge of personal finance.

Your financial institution may have its own financial education program. Talk to an expert, they’re here to help!

Calculator – credit card

Exercise one or more of these tools will allow you to fully understand the risks associated with interest payments, improve your use of credit and help you limit debt:

Calculator – credit card of the Financial Markets Authority

Calculator – credit card of the Financial Consumer Agency of Canada

Further reading

- Do You Really Need It?

De Pierre-Yves McSween - Ça coûte cher, être un adulte!: comment gérer tes finances comme un pro (ou presque)

De Béatrice Bernard-Poulin