Personal Finance

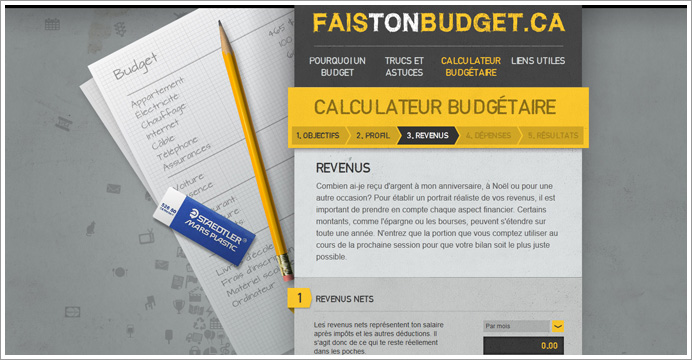

Faistonbudget.ca

Making a budget may sometimes seem tedious, but the benefits can be big. It helps you achieve specific financial goals, focus on your priorities, reduce stress, prepare for unforeseen events, and avoid the consequences of excessive debt.

An effective and useful tool!

Faistonbudget.ca provides tools to help you increase or update your knowledge of personal finances and an interactive calculator so you can create a personalized budget to guide you when making financial decisions.

Resorting to credit

Using credit is part of managing your personal finances. Here are some examples of types of credit:

|

|

Pitfalls to avoid

- Giving in to tempting products offered by lenders

- Impulse buying

- Using credit with very high interest rates

- Making late credit card payments

- Having multiple credit cards

- Failing to monitor credit card limits, which institutions can increase with or without notice

Useful advice

- Use only one credit card that has a very reasonable limit

- Check your receipts against your bank account and credit card statements

- Pay your credit card balance in full each month to avoid paying interest

- Shop around when it comes to lenders’ interest rates for all types of credit

- Avoid using credit for living expenses like food

Benefits of Loans and Bursaries compared to a line of credit

Comparative Table

Line of credit |

Loans and Bursaries |

|

| Interest rates |

|

Determined by the government, usually lower than rates offered by financial institutions |

| Interest during studies | Must be paid during school or added to the debt | The Ministère pays the interest during Full-time studies |

| Acquisition | Credit check required | No credit check |

| Other features |

|

Amount determined by the Ministère to fulfil students’ everyday needs |

| Other benefits | Total amount must be repaid after the end of studies |

|

Getting out of debt

The debt situation

A problematic debt situation is when you are unable to pay basic expenses such as

- The minimum amount on your credit cards

- Your telephones bills

- Your rent

- Your tuition fee

Practical advice

When you use credit to cover your living expenses and don’t know how you will pay off your debts, there are ways of resolving the situation. Here are some tips:

- Examine your spending habits and ask yourself: do I really need it?

- Destroy your credit cards or just keep one if you think you need it

- Keep a small amount of cash on you

- Assess your ability to work

- Review and analyze your personal expenses in depth

- Prioritize debt repayment

- Make arrangement with your creditors

- Consider consolidating your debts with your financial institution

- Deposit your income in a savings account and transfer the amount you need for your regular expenses twice a month

- Meet with a counsellor

Debt-tracking Table

To get a good idea of your financial situation, it may be useful to make a list of all your debts, whether owed to a financial institution or to an individual. To better plan the repayment of your debts, you can use tools such as a debt repayment calculator.

Example of a debt-tracking table

| Debt | Amount due | Interest rate | Minimum monthly payment | Due date | Interest start date | Repayment start date |

Download the table (Excel)

Sample Student Annual Budget Budget Consultation